Cryptocurrencies have revolutionized financial markets, presenting opportunities that can lead to substantial profits. While "getting rich overnight" with crypto is a misleading dream for many, systematic and well-informed strategies can set you on the path to financial freedom. This article will demystify the world of crypto farming, staking, and compounded returns, offering a clear, actionable guide for both beginners and seasoned investors.

Four Main Crypto Investment Strategies

Here's an overview of the primary ways to earn money with cryptocurrencies:

1. HODLing (Long-Term Holding)

HODLing involves buying cryptocurrencies like Bitcoin or Ethereum and holding them for an extended period, regardless of market fluctuations. This method is ideal for:

- Investors looking for lower-risk, steady returns.

- Those who believe in the long-term potential of specific coins.

2. Trading

Trading focuses on short-term price movements. While it offers potential for quick profits, it requires:

- In-depth technical analysis.

- Emotional discipline to handle losses.

- High levels of market understanding.

⚠️ Warning: Statistics show that most traders lose money due to lack of experience and emotional decision-making.

3. Staking and Farming

- Staking: Earn passive income by locking your tokens in a network to secure its blockchain. Rewards usually range from 5% to 10% annually.

- Farming: Provide liquidity to decentralized exchanges (DEXs) and earn rewards from transaction fees. Though riskier than staking, farming offers significantly higher returns.

4. Airdrops

Earn free tokens by participating in promotional campaigns for new crypto projects. Airdrops are especially beneficial for investors with minimal capital.

Farming and Staking: The Heart of Passive Income

Farming and staking are among the most effective ways to generate passive income in the cryptocurrency space. These strategies allow you to make your crypto assets work for you, rather than sitting idle in your wallet. Let's dive deeper into these concepts to understand their benefits and mechanics.

What is Staking?

Staking involves locking your cryptocurrencies into a blockchain network to support its operations, such as validating transactions. In return, you receive rewards, usually in the form of more tokens.

- Purpose: Staking secures the blockchain and maintains its functionality.

- Rewards: Typically, the annual percentage yield (APY) ranges from 5% to 10%.

- Best for: Investors looking for low-risk, stable returns.

Example:

If you stake $10,000 worth of a cryptocurrency with a 10% APY, you would earn $1,000 by the end of the year.

What is Farming?

Farming (or yield farming) is a more advanced strategy where you provide liquidity to decentralized exchanges (DEXs) and earn a share of the transaction fees generated by traders.

- Purpose: Enhance liquidity for trading pairs on DEXs.

- Rewards: Yield farming often offers much higher returns than staking, sometimes exceeding 100% APY. However, it also comes with higher risks, including impermanent loss and market volatility.

- Best for: Experienced investors who understand liquidity pools and risk management.

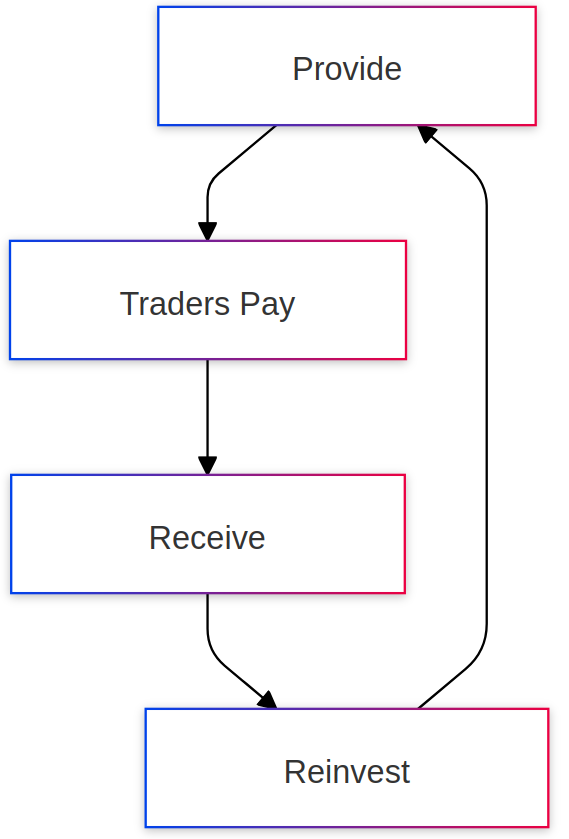

The Mechanics of Yield Farming

Here's how farming works step-by-step:

- Pair Cryptocurrencies

Choose two cryptocurrencies to pair (e.g., ETH and USDT) and provide liquidity to their trading pool. - Earn Rewards

As traders swap between these assets, they pay transaction fees, which are distributed to liquidity providers like you. - Reinvest Rewards

Use your rewards to compound your returns by reinvesting them back into the liquidity pool.

The flow of farming is illustrated below:

Steps to Start Farming

1. Selecting a Blockchain and Exchange

- Use reliable DEXs like Uniswap, PancakeSwap, or Orca.

- Ensure the platform has high trading volume and security.

2. Providing Liquidity

- Pair two assets, such as Bitcoin and Ethereum.

- Deposit them into a liquidity pool, earning transaction fees.

3. Managing Risk

Beware of:

- Impermanent Loss: A temporary loss in asset value due to market volatility.

- Hacks or Rug Pulls: Only use reputable DEXs with a strong track record.

4. Automating the Process

Platforms like Beefy Finance simplify farming by automating reinvestment and range adjustments.

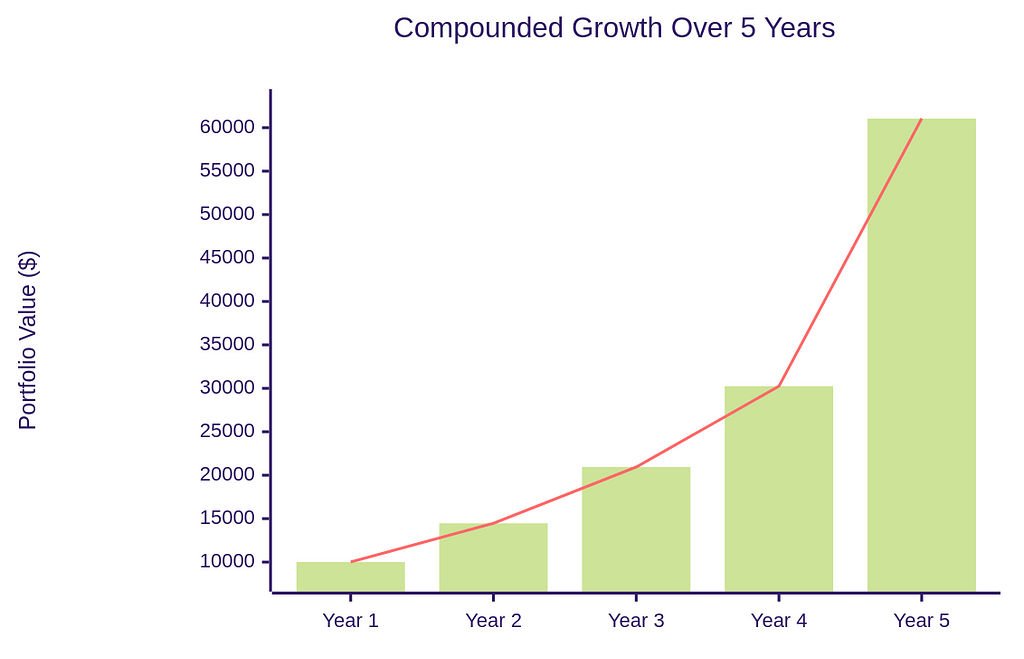

The Power of Compounding

Compounding is what transforms farming from a modest income stream into a powerful wealth-building tool. By regularly reinvesting your farming rewards, your earnings grow exponentially over time.

Example with Daily Interest:

- Initial Investment: $10,000

- Daily Interest: 0.1%

- After 5 Years: $10,000 grows to $61,051 with consistent reinvestment.

Key Risks to Manage

While farming and staking offer excellent opportunities, it's essential to understand the risks involved:

1. Impermanent Loss

When the price of the assets in your liquidity pair changes significantly, the pool automatically rebalances. This can lead to a temporary loss in the value of your holdings compared to simply holding the tokens.

How to Mitigate:

- Use stablecoin pairs (e.g., USDT/USDC) to minimize price fluctuations.

2. Hacks and Rug Pulls

The decentralized nature of DEXs makes them a target for hackers. Additionally, malicious developers can execute rug pulls, draining liquidity pools and leaving investors with nothing.

How to Mitigate:

- Stick to established DEXs like Uniswap or PancakeSwap.

- Research project teams and their security audits.Select pairs with historically low volatility.

Best Practices for Success

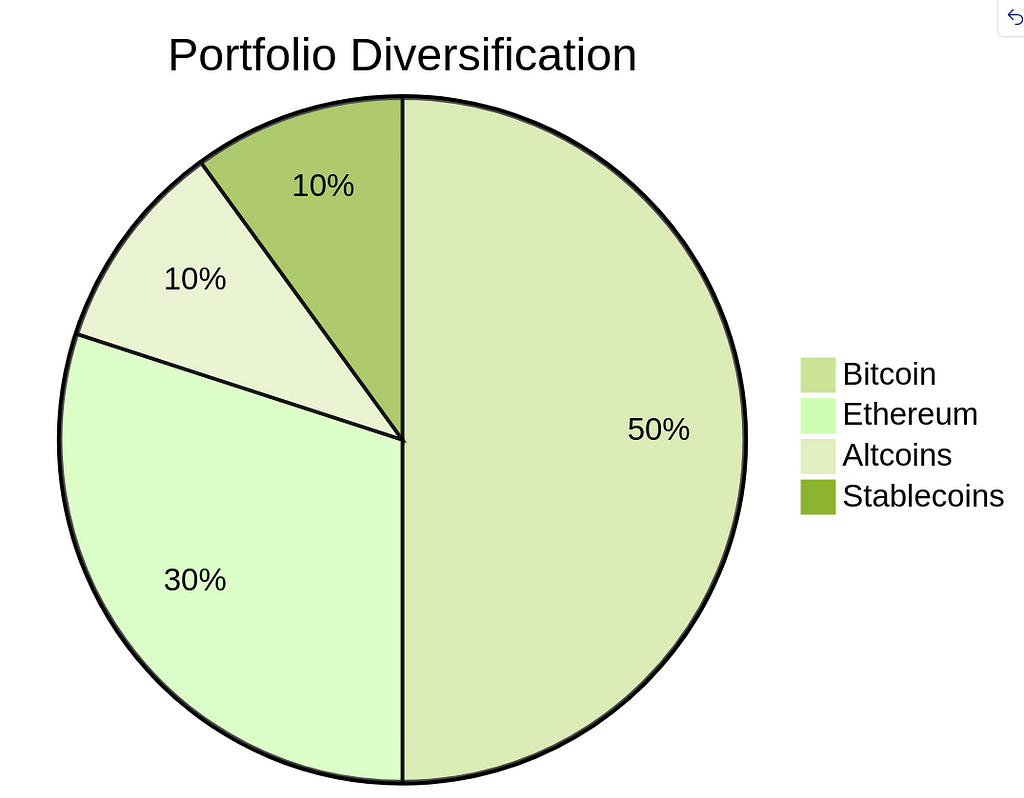

Diversify Investments

Four Core Principles for Success

- Patience and Consistency

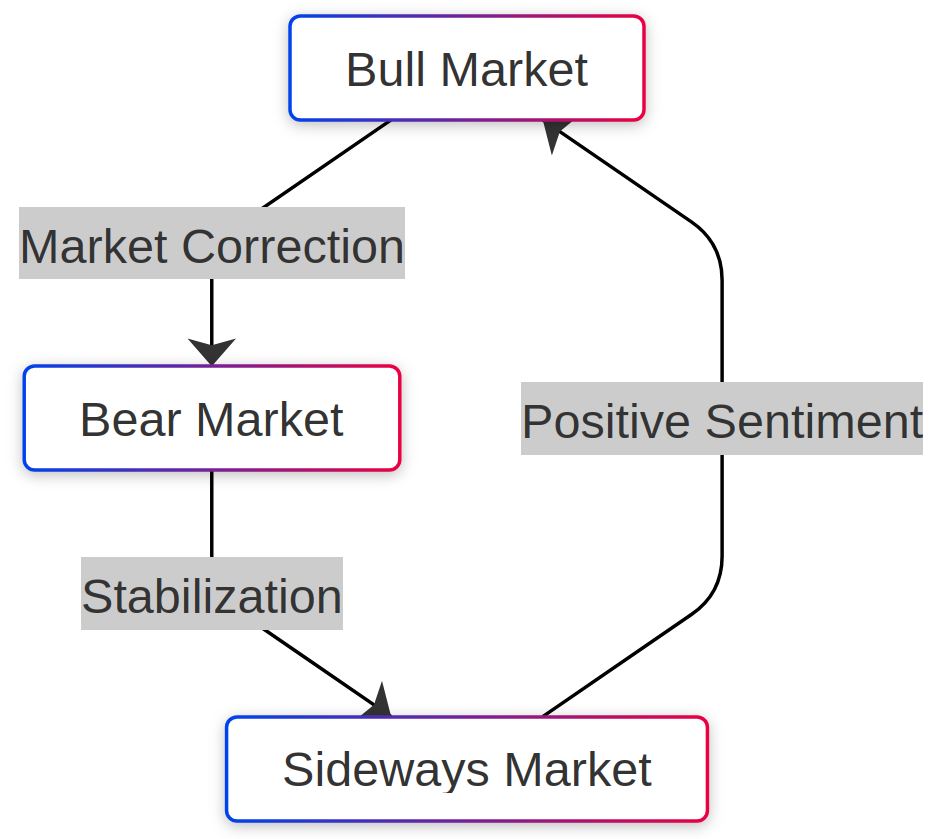

Compounding takes time. Don't expect immediate results — stay consistent, and let time amplify your earnings. - Market Adaptability

Crypto markets evolve rapidly. Reassess your strategies periodically and adjust your liquidity pools based on current opportunities. - Tool Cryptocurrencies as Tools

In farming, cryptocurrencies are not for sentimental attachment. Choose pairs based on their return potential, not personal preference. - Diversification

Spread your investments across multiple pairs, exchanges, and blockchains to mitigate risk.

Farming and staking represent two sides of the passive income coin. Staking offers lower risks with stable returns, while farming provides higher rewards at the cost of increased complexity and risk. With the power of compounding, even small investments can grow into substantial wealth over time.

To succeed, remember to:

- Start small and gradually scale up as you learn.

- Diversify and manage risks effectively.

- Stay patient and consistent.

Cryptocurrency investing is not just about profits — it's about building a sustainable, long-term strategy. Happy farming!

source: https://raglup.medium.com/unlocking-crypto-wealth-the-power-of-farming-staking-and-compounding-returns-0f8b66f99298?source=rss-f56f44caad34------2

No comments:

Post a Comment